The Rise of Market Participants in Cryptocurrency and Financial Markets

In recent years, the cryptocurrency market has experienced unprecedented growth and volatility. As a result, several market participants have emerged to capitalize on this trend. Among these market participants is the

Market Maker, a unique role that combines elements of a market maker and a liquidity provider.

What is a Market Maker?

A market maker is an entity that provides a counterparty to buy or sell orders at a specified price, often taking on the risk of both buying and selling an asset. In traditional markets such as stocks, currencies, and futures, market makers act as intermediaries between buyers and sellers, providing liquidity and enabling price quotes.

The Emergence of Market Participants in Cryptocurrency Markets

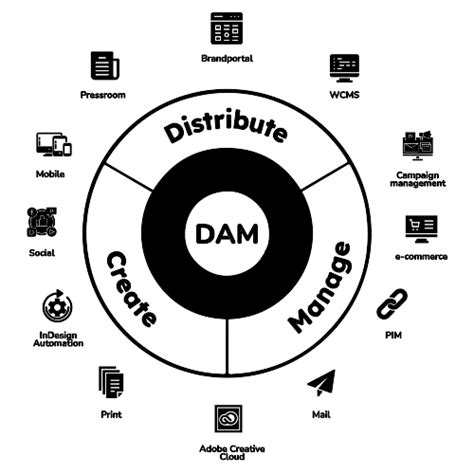

In the cryptocurrency sector, market makers have evolved to meet the unique requirements of a decentralized, blockchain-based market. The introduction of

digital asset management (DAM) platforms such as Coinbase and Kraken have created an environment where investors can buy, sell, and hold cryptocurrencies with relative ease.

To facilitate these transactions, specialized market makers known as

Market Takers have emerged. Market Takers play a key role in maintaining order and stability in cryptocurrency markets by providing liquidity and absorbing price fluctuations. They act as counterparty risk managers, ensuring that both buyers and sellers have access to the necessary funds to execute transactions.

Characteristics of Market Takers

Market Takers typically possess certain characteristics, including:

- Liquidity provision: The ability to deliver a large number of buy or sell orders at different prices.

- Risk management: The ability to absorb price fluctuations and maintain market stability.

- Compliance: Adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations, ensuring the integrity of their operations.

Key Benefits of Market Takers

The emergence of Market Takers has brought several benefits to cryptocurrency markets:

- Increased Efficiency: By providing liquidity and managing counterparty risk, market makers can reduce transaction costs and improve market efficiency.

- Enhanced Security: The use of advanced risk management techniques helps ensure that market participants are protected in the event of price changes or other adverse events.

- Increased Stability

: Market Takers help maintain order and stability in cryptocurrency markets, reducing the likelihood of price shocks and market volatility.

Challenges and Limitations

While Market Takers have revolutionized the way cryptocurrencies are traded and stored, their role also comes with its own challenges and limitations:

- Regulatory Control: Market makers must adhere to increasingly stringent regulations, which can lead to increased costs and complexity.

- Counterparty Risk Management

: The ability of market makers to effectively manage counterparty risk is critical; however, this requires significant resources and expertise.

- Market Complexity: Cryptocurrency markets are rapidly evolving, requiring Market Takers to stay abreast of changing regulations and market conditions.

Conclusion

The emergence of Market Takers in the cryptocurrency space has transformed the way these assets are traded and stored. By providing liquidity, managing risk, and maintaining order, Market Takers have become an essential part of the cryptocurrency ecosystem. As the market matures, it is critical that both regulators and market participants understand the complexities of Market Takers’ activities and their role in shaping the future of cryptocurrency markets.