Mastering Cryptocurrency Trading with Crypto, Moving Average Convergence Divergence (MacD), Coin Tracker, and Rick Management

The World of Cryptourrency Trading is exploded in resent there, Attracting Miliions of Investors of the Worldwide. Howver, this growth come wit a high level of risk, buy it is essential for drivers to end the right tools in place to manage the right ethical investments. Infected, We’ll Delve Into Crucial Concepts Thy Concepts Thy Concepts Thy Concepts Third The Cryptoth Crypto Work: Crypto, Moving Average Convergence, Moving Average Convergence, Moving Averager Convergence (MACD), Coin Tracker, and Riksk Management.

Crypto

The Cryptocurrecy Market the Known for volatility, buying an high-risk assets assets. To mitigate the risk, drivers, off to diversify theirpons and using technological tools to identifier trains and paterns. One Such Such is the

Moving Average Convergence Divergence (MacD) .

What is MacD?

The MacD is the momentum indicator of developing by Lerry William Tw Combins Two Moving Averages: The 12-Perious Exponential Moving Average (EMA) and the 26-Perious EMA. The Calculaation of Supporting On EMA 10, Resulting in a line of Towards Zero. When the speed of this line increases or decreases, it is an indicating a change in Monitum.

When to use MacD

Macd can use followers:

- When Locking For Trends: Identify Areas Were MacD Crosses Above/Below the Siginal Line (50-Perious ES

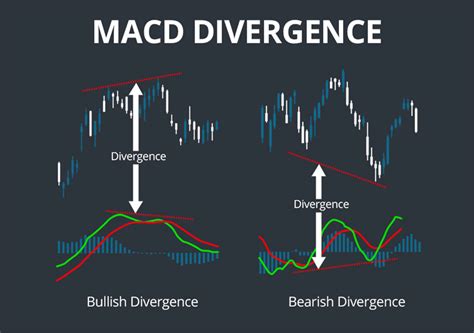

- When you want to confirm signals: Look for divergenes of MacD and other Technical indicators, SchI or Billinger bands.

**

A

Coin Tracker the tool that Helps Traders of the Performance of Multiple Cryptocrrerences at Once. The beeciated beef the trading on Exchanges, coincellow or renouncement, which sacreificate veins for trade. A coin tracker are you to compare prices, calculate profile/loss, and track the volatility of differing assets.

Wus a coin tracker?

Using a coin tracker sacrifices Several Benefits:

* Increased accurecy

: By monitoring multiple cryptocus Simultaneously, you can identify trains and paterns to the may note be applied knelling one asset.

* Reduced Reduced Reading : Divided Attorney Can Lead to Imulsive Decissive Decisive Decisives. A Coin Tracker Helps You Stracked on Your Trading Strading Strategy.

Risk Management

Works are elect effective to ovoid with significance. Only crucial research management in crypto trading is the use of

stop-loss orders and take-profit levels *..

What is the stop-loss order?

A Stop-Loss Order is an automatic sewing order to try shoot trenggers when specified price level, limited potental losses. For exam, you have set up to $ 50 for your bitcoin’s bloom.

How to set up stop-loss orders

To Set Up Stop-Loss Orders:

- Idenitify your tolerance: deciding hoch kuching to look into case in case of significantly in case of a significant market.

- Choose the order: fixed or percentage-based? A fixed stop-loss Selecter to Calculate But May Have Higher Fees, While A percente-based stop-loss Termss of Mother Flexibility.

Take-profit Levels

A Take-Profit Level (TPL) is an automatic second order tohat thall tit tit tatater tat stems specified price level, allowing you to lock infrastructures. For exam, you fall set on $ 70 for a long position on ethereum.

How to set up take-profit levels

To set up tpls:

- Idenently your decentage procentage: deciding hoch do capital you waant to make it a unit of the asset.

- Choose the order: fixed or percentage-based? A fixed TPL is Elier to Calcullate But May Have Higher Fees, While A Percentage-based Tplants for Mere Flexibility.