Here is a comprehensive article on crypto patterns, ledgers, and continuation patterns, with a focus on swaps:

Introduction

The world of cryptocurrencies is a vast and complex space where investors and traders have many tools and techniques at their disposal. In this article, we will look at three key concepts: crypto (Ledger), continuation pattern, and swapping.

Crypto (Ledger)

Cryptocurrencies, in the context of blockchain technology, refer to cryptocurrencies that use a public ledger called a “blockchain” to record transactions. The most well-known cryptocurrency is Bitcoin, which uses the X11 algorithm to secure and verify transactions on its network.

However, other cryptocurrencies such as Ethereum, Litecoin, and Monero also use the same blockchain technology. This enables decentralized, peer-to-peer (P2P) trading and investment opportunities.

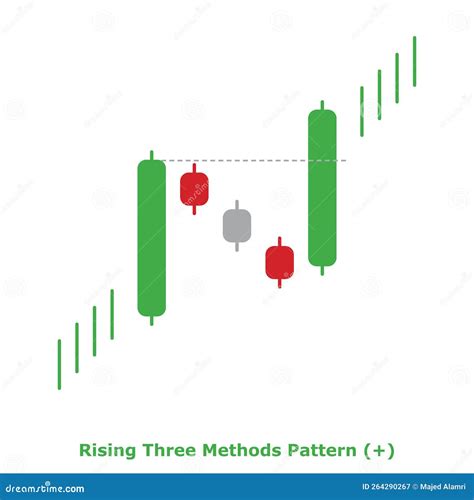

Continuation Pattern

The continuation pattern is a popular strategy used by cryptocurrency traders. It involves buying or holding a cryptocurrency at its highest price, then selling it when the price drops.

Here’s how the pattern works:

- Buy at the top: Buy the cryptocurrency at its highest price.

- Wait for the drop: Wait for the price to drop below your buy point.

- Sell for profit: Sell the cryptocurrency at a lower price to secure a profit.

The continuation pattern is based on the assumption that prices will fall, and then buyers will be willing to pay even more. By selling at a lower price, you can make a profit when demand falls.

Swapping

A swap is an advanced technique used by experienced traders to take advantage of market imperfections. It involves buying a cryptocurrency at one price and selling it at another, often at the same time as other transactions.

Here’s how swaps work:

- Price Identification: Identify two or more different cryptocurrencies with different prices.

- Set Trades: Set up multiple trades at once to buy and sell cryptocurrencies at different prices.

- Rebalancing

: Rebalance your portfolio by adjusting trade amounts based on market movements.

Making swaps requires a deep understanding of the cryptocurrency markets, technical analysis, and trading strategies.

Example

Let’s say you’re interested in buying Bitcoin (BTC) for $10,000 and selling it for $8,000. You could use a Continuation Pattern to buy BTC for $15,000 and sell it for $12,000, then lock in a profit of $3,000.

However, by using Swapping, you can also take advantage of market inefficiencies by buying Bitcoin (BTC) for $10,000 and selling it for $8,000. You could then immediately buy another BTC for $9,500 and sell it for $12,000, locking in a profit of $3,500.

Conclusion

Cryptocurrencies, ledgers, and swap continuation patterns are powerful tools that traders can use to capitalize on market opportunities. However, they require a deep understanding of cryptocurrency markets, technical analysis, and trading strategies.

By mastering these concepts, traders can increase their chances of achieving success in the rapidly evolving world of cryptocurrency trading.