Decentralized Finance: A Guide to Cryptocurrencies, Pyth Network, and Custody

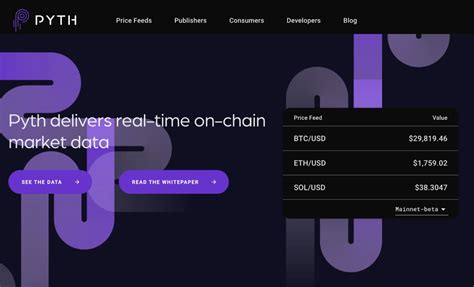

The world of cryptocurrency has come a long way since its inception in 2009. With the rise of decentralized finance (DeFi), the lines between traditional banking and digital currencies have blurred significantly. Among the players vying for dominance in this space is Pyth Network (PYTH). In this article, we delve into the world of crypto, Pyth Network, and custodianship to explore how these concepts work together.

What is Pyth Network?

Pyth Network is a decentralized application platform that allows users to build, deploy, and manage their own DeFi applications. Launched in 2021, Pyth has gained significant traction in the cryptocurrency market due to its user interface, scalability, and innovative features. Pyth allows developers to build custom applications for a variety of use cases, from lending and borrowing to trading and staking.

Custody Services: The Role of the Pyth Network

Custody services refer to the management and storage of digital assets on behalf of users or organizations. In traditional banking systems, custodians act as intermediaries between depositors and lenders, ensuring safe and efficient transactions. The Pyth Network Custody Service is designed to provide a similar experience for users.

Here’s how it works:

- User Accounts: Users create an account on the Pyth platform, which includes a unique address (public key) and a private key.

- Staking: When users want to store their assets, they can stake their coins using Pyth staking protocols such as Matic or Binance Smart Chain.

- Decentralized Governance: The invested assets are pooled in a decentralized governance system, ensuring that all stakeholders have equal influence in the decision-making process.

Bridge: The Central Part of Decentralized Finance

Bridge is a central part of the DeFi ecosystem, enabling seamless interaction between different blockchains and cryptocurrencies. Pyth Network Bridge allows users to transfer funds between chains without the need for intermediaries or centralized exchanges.

Here’s how it works:

- Chain Transfer:

When users want to transfer funds from one chain to another, they use the Pyth Bridge.

- Smart Contract Integration:

The transaction is executed by smart contracts on both chains, ensuring efficient and secure transactions.

- Cross-Chain Stability: Bridge also offers cross-chain stability solutions, allowing users to store their assets on a single chain for optimal performance.

Benefits of Custody Services and Pyth Network Bridge

Custody Services and Pyth Network Bridge offer users several benefits:

- Security and Efficiency: By storing assets on Pyth, users can enjoy secure storage and efficient transactions.

- Decentralized Governance: The decentralized governance system ensures that all stakeholders have an equal say in the decision-making process.

- Cross-Chain Stability: The Bridge provides solutions for cross-chain stability, allowing users to seamlessly transfer assets between chains.

Conclusion

Pyth Network has revolutionized the DeFi world by providing a user interface for building and managing custom applications. Its Custody Services and Bridge have enabled seamless interaction between different blockchains and cryptocurrencies, making it an attractive option for users looking for secure storage and efficient transactions. As the cryptocurrency space continues to evolve, Pyth Network’s innovative solutions are likely to play a significant role in shaping the future of DeFi.

Sources:

- Pyth Network White Paper

- CoinGecko article on Pyth Network

- Coindesk article on Pyth Bridge