Title: Unlocking the Future of Finance: How Crypto, Swaps, and Blockchain Scalability Are Transforming Supply Chains

Introduction

The world of finance is undergoing a significant transformation with the emergence of new technologies that are disrupting traditional ways of doing business. One area that has seen rapid growth in recent years is cryptocurrency. The rise of decentralized applications (dApps) and non-fungible tokens (NFTs) has created a new landscape for financial transactions. Another technology that has received significant attention is blockchain scalability, which enables fast and efficient peer-to-peer transactions without the need for intermediaries. In this article, we explore how crypto, swaps, and blockchain scalability are transforming supply chains.

Crypto and Swaps

Cryptocurrency has become an integral part of modern finance, with many businesses using it as a means of payment, investment, or collateral. The decentralized nature of cryptocurrencies allows for faster and cheaper transactions than traditional systems. In supply chain management, crypto is used to facilitate fast and secure payments between buyers and sellers.

One example is the use of blockchain-based platforms such as Chainalysis, which provide a secure and transparent way to track the movement of goods throughout the supply chain. By using cryptocurrencies such as Bitcoin or Ethereum, companies can reduce their dependence on traditional payment systems and streamline their logistics operations.

Blockchain Scalability

As the demand for cryptocurrencies continues to grow, so does the need for scalable solutions. Blockchain scalability refers to the ability of a blockchain network to process large numbers of transactions per second without compromising security or compromising data integrity.

One of the biggest challenges in blockchain adoption is the lack of scalability. Current consensus algorithms, such as Proof-of-Work (PoW), are slow and energy-intensive, making it difficult to process large transactions quickly enough for real-time applications. To address this issue, developers have explored alternative consensus algorithms, such as Sharding, which can divide the network into smaller, independent blockchains that can handle more traffic.

Impact on the supply chain

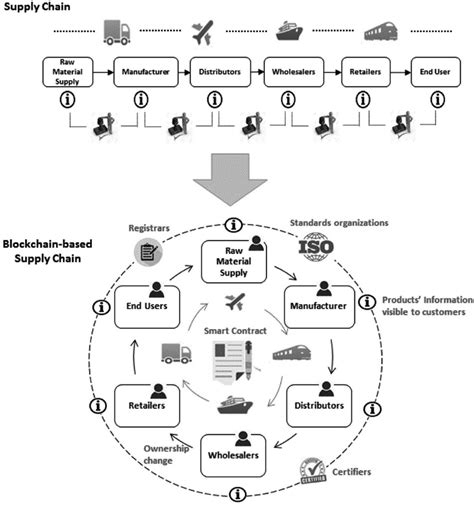

The use of blockchain scalability solutions has significant implications for supply chains. Faster and cheaper transactions allow companies to reduce their reliance on intermediaries and increase transparency throughout the process. This can improve customer satisfaction, lower costs, and improve competitiveness in the marketplace.

One notable example is the adoption of blockchain-based platforms, such as IBM’s Blockchain Supply Chain Platform. Blockchain technology allows companies to create a secure and transparent supply chain that reduces risk, improves efficiency, and increases customer trust.

Supply Chain Challenges

While the benefits of crypto, swaps, and blockchain scalability are clear, the industry also faces significant challenges. One major challenge is regulatory uncertainty as governments around the world grapple with regulating cryptocurrencies and blockchain technology.

Another challenge is interoperability issues that can make it difficult for different systems to communicate and exchange information seamlessly. To address this issue, developers are exploring new standards, such as Hyperledger Fabric, which allows multiple blockchains to exist on a single network.

Conclusion

The rise of crypto, swaps, and blockchain scalability is fundamentally changing the world of finance and supply chains.